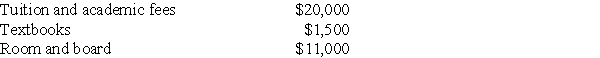

Burton and Kay are married,file a joint return with an AGI of $116,000,and have one dependent child,Tyler,who is a full-time student in a Master of Accountancy program.The following expenses relate to his costs of attendance in 2017:

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

The tuition noted above is the gross amount charged before reduction for his $5,000 tuition scholarship.What is the maximum education credit allowed to Burton and Kay?

Definitions:

Monsoon

Refers to winds that reverse directions depending on the season.

Land Breeze

A local wind that blows from the land to the sea due to higher- pressure air over the land.

Offshore Breeze

A wind that blows from the land towards the sea, typically during the day due to temperature differences.

Low Pressure

An area where the atmospheric pressure is lower than that of the surrounding regions, often leading to poor weather conditions.

Q18: Sarah owned land with a FMV of

Q35: Eva is the sole shareholder of an

Q49: Dean exchanges business equipment with a $120,000

Q58: Interest is not imputed on a gift

Q62: William purchases nonresidential real property costing $300,000

Q73: With respect to charitable contributions by corporations,all

Q86: Under the cash method of accounting,income is

Q98: The Smiths owned and occupied their principal

Q103: On January 1 of the current year,Dentux

Q115: If a corporation distributes appreciated property to