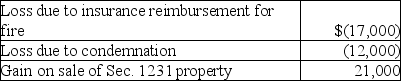

This year Jenna had the gains and losses noted below on property,plant and equipment used in her business.Each asset had been held longer than one year.Jenna has not previously disposed of any business assets.  Jenna will recognize

Jenna will recognize

Definitions:

Reagent Strip

A diagnostic tool used to determine changes in urine composition that can indicate various medical conditions.

Ice Container

A receptacle used to hold ice, ensuring it stays frozen and clean for use in various applications, such as medical treatment or food preservation.

Catheter Removal

The process of safely taking out a catheter (a tube inserted into the body for removing fluids) from the body, often done following medical guidelines to prevent infection.

Dribbling Urine

Involuntary leakage of small amounts of urine, often a symptom of underlying medical issues.

Q40: If certain requirements are met,Sec.351 permits deferral

Q43: James and Ellen Connors,who are both 50

Q58: Chahana acquired and placed in service $665,000

Q61: A business uses the same inventory method

Q72: For income tax purposes,a taxpayer must use

Q108: Frank,a single person,sold his home this year.He

Q110: Identify which of the following statements is

Q110: Kuda owns a parcel of land she

Q137: All of the following are allowable deductions

Q140: A corporation is owned 70% by Jones