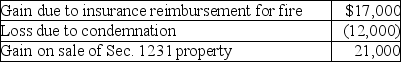

This year Pranav had the gains and losses noted below on property,plant and equipment used in his business.Each asset had been held longer than one year.  A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

A review of Pranav's reporting of Sec.1231 transactions for the prior five years indicates a net Sec.1231 loss of $14,000 three years ago and a net Sec.1231 gain of $8,000 last year (before the five-year lookback) .Pranav will recognize

Definitions:

Eleanor Roosevelt

A prominent American political figure, diplomat, and activist, who served as the First Lady of the United States from 1933 to 1945 during the presidency of her husband, Franklin D. Roosevelt.

Indian New Deal

A series of reforms and policies implemented in the 1930s aimed at supporting the sovereignty and economic development of Native American tribes.

American Women

Refers to the role, status, and experience of women in American society, which has evolved over time and varies across different periods and communities.

Great Depression

A severe worldwide economic downturn that took place during the 1930s, leading to widespread unemployment, poverty, and significant social upheaval.

Q1: The primary citation for a federal circuit

Q40: Many taxpayers use the LIFO method of

Q51: Corporate charitable contributions are limited in any

Q51: Amelia exchanges a commercial fishing boat with

Q63: How does the treatment of a liquidation

Q85: Which of the following statements with respect

Q101: Individuals Terry and Jim form TJ Corporation.Terry

Q105: Dozen Corporation is owned equally by twelve

Q107: Accrual-basis corporations may accrue a charitable contribution

Q130: Corporations that are members of a parent-subsidiary