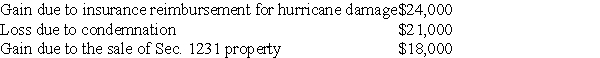

The following gains and losses pertain to Jimmy's business assets that qualify as Sec.1231 property.Jimmy does not have any nonrecaptured net Sec.1231 losses from previous years,and the portion of gain recaptured as ordinary income due to the depreciation recapture provisions has been eliminated.

Describe the specific tax treatment of each of these transactions.

Describe the specific tax treatment of each of these transactions.

Definitions:

Fill Orders

The process of completing customer orders by preparing and delivering the requested goods.

Environmental Stewardship

The responsible management and conservation of natural resources and the environment through sustainable practices.

Corporate Social Responsibility

A concept whereby organizations consider the needs of all stakeholders when making decisions.

Performance Measure

Indicators used to evaluate the efficiency, effectiveness, and success of an organization or its employees.

Q36: Which of the following partnerships can elect

Q40: An unincorporated business sold two warehouses during

Q42: All of the following are self-employment income

Q45: Advance approval and the filing of Form

Q47: A taxpayer owns an economic interest in

Q92: When appreciated property is transferred at death,the

Q98: Doug is going to sell land for

Q101: An accrual of a reserve for bad

Q117: Pierce sold his home this year.He had

Q128: Use a citator to determine the current