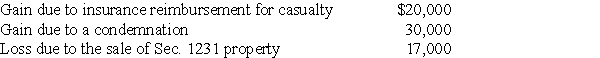

The following are gains and losses recognized in 2017 on Ann's business assets that were held for more than one year.The assets qualify as Sec.1231 property.

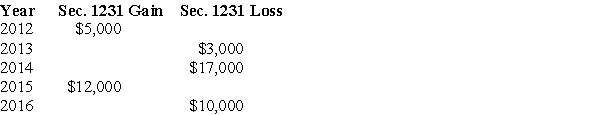

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

A summary of Ann's net Sec.1231 gains and losses for the previous five-year period is as follows:

Describe the specific tax treatment of each of the current year transactions.

Describe the specific tax treatment of each of the current year transactions.

Definitions:

Online Presence

The visibility and engagement of an individual or organization across digital platforms, including websites and social media, influencing their reputation and reach.

Organization's Products

The goods or services produced and offered by a business or entity.

Company's Development

The process of growing or improving a company through expansion, innovation, or increasing its market presence.

Organizational Grapevine

A rephrased term for informal networks within a company through which rumors and unofficial information circulate among employees.

Q9: A corporation sold a warehouse during the

Q50: Janice transfers land and a building with

Q59: Section 179 allows taxpayers to immediately expense

Q60: Nick sells land with a $7,000 adjusted

Q81: Dixie Corporation distributes $31,000 to its sole

Q93: Why should tax researchers take note of

Q94: On May 18,of last year,Yuji sold non-publicly

Q113: Kuda owns a parcel of land she

Q126: Octo Corp.purchases a building for use in

Q138: A U.S.-based corporation produces cereal in Niagara