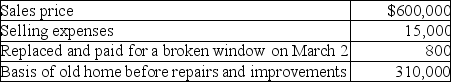

Pierce sold his home this year.He had owned and lived in the house for 10 years.Pierce signed a contract on March 4 to sell his home.  Based on these facts,what is the amount of his recognized gain?

Based on these facts,what is the amount of his recognized gain?

Definitions:

Salesperson

A professional responsible for selling products or services to customers, often involving direct interaction or negotiation.

Professional Salesperson

An individual specialized in persuading or influencing others to purchase goods or services in exchange for money.

Prospect's Objection

Concerns or reasons given by a potential buyer for hesitating or declining to purchase a product or service.

FAB Sequence

A sales technique that highlights the Features, Advantages, and Benefits of a product or service to the customer.

Q3: If no gain is recognized in a

Q4: In an involuntary conversion,the basis of replacement

Q11: Yulia has some funds that she wishes

Q33: Jose dies in the current year and

Q56: Mr.and Mrs.Lewis have an alternative minimum tax

Q61: Installment sales of depreciable property which result

Q73: Elijah contributes securities with a $90,000 FMV

Q87: Vector Inc.'s office building burns down on

Q94: On May 18,of last year,Yuji sold non-publicly

Q101: Harry owns equipment ($50,000 basis and $38,000