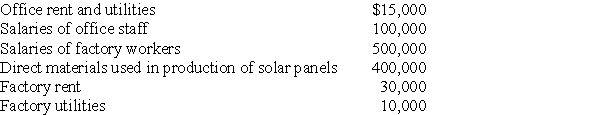

Xerxes Manufacturing,in its first year of operations,produces solar panels which are sold through large building supply and home improvement stores.Xerxes' year-end results include the following:

You are preparing Xerxes' first year tax return.Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

You are preparing Xerxes' first year tax return.Xerxes has elected a calendar year as its tax accounting period and the accrual method.What additional information would you need to prepare the tax return?

Definitions:

Voting Shares

Voting shares are shares of stock in a company that grant the shareholder the right to vote on corporate matters, typically in proportion to the number of shares held.

Fair Value

The approximate financial worth of an asset or liability, determined by existing prices in a transparent and contestable market.

Fully Amortized

Pertains to a loan or mortgage that has been completely paid off, principal and interest, over its term.

Direct Combination Costs

Expenses directly associated with the execution of a business combination, such as legal fees, consulting fees, and other administrative costs.

Q3: In November 2017,Kendall purchases a computer for

Q32: Quattro Enterprises,a calendar-year taxpayer,leases the twentieth floor

Q34: During the current year,Hugo sells equipment for

Q45: Amelida expects to earn $145,000 of AGI

Q57: On June 11,of last year,Derrick sold land

Q64: All of the following qualify as a

Q68: If the business use of listed property

Q77: Alan files his 2016 tax return on

Q82: If property is involuntarily converted into similar

Q88: The earned income credit is refundable only