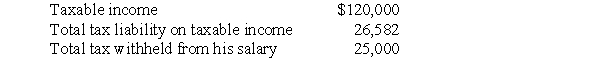

Frederick failed to file his 2017 tax return on a timely basis.In fact,he filed his 2017 income tax return on October 31,2018, (the due date was April 17,2018)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2017 return:

Frederick sent a check for $1,582 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2017.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,582 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2017.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Nonviolence

A principle of conflict resolution and political strategy that rejects the use of physical violence in order to achieve social or political change.

Prosocial Behavior

Helping behavior that benefits others.

Immanent Justice

The belief, particularly common in children, that moral behavior is immediately rewarded and immorality is instantly punished in a natural or magical manner.

Postconventional Morality

A stage in Kohlberg's theory of moral development where an individual's sense of morality is defined by internal principles, and social rules are seen as relative and not absolute.

Q3: A partnership must generally use the same

Q8: What basis do both the parent and

Q19: Why are other intercompany transactions not given

Q22: Identify which of the following statements is

Q31: Allen contributed land,which was being held for

Q44: Amber receives a residence ($750,000 FMV,$500,000 adjusted

Q57: All corporations,except S corporations and small C

Q59: Which of the following is not one

Q82: If property is involuntarily converted into similar

Q85: What are the differences,if any,in the tax