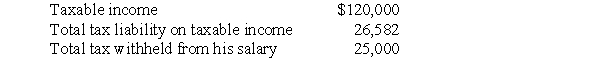

Frederick failed to file his 2017 tax return on a timely basis.In fact,he filed his 2017 income tax return on October 31,2018, (the due date was April 17,2018)and paid the amount due at that time.He failed to make timely extensions.Below are amounts from his 2017 return:

Frederick sent a check for $1,582 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2017.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Frederick sent a check for $1,582 in payment of his liability.He thinks that he has met all of his financial obligations to the government for 2017.For what additional amounts may Frederick be liable assuming any applicable interest rate is 6%?

Definitions:

Actual Revenue

The real income that a company receives from its business activities, measured over a specific period.

Static Planning Budget

A budget for a specific amount of sales or production that does not change as volume changes.

Activity Variance

The difference between the planned activity and the actual activity in terms of costs or hours.

Flexible Budget

A budget that adjusts or flexes with changes in the volume or activity level, allowing better analysis and control of costs.

Q14: Blue and Gold Corporations are members of

Q29: Explain how returns are selected for audit.

Q58: Chahana acquired and placed in service $665,000

Q58: Interest is not imputed on a gift

Q67: Eric exchanges a printing press with an

Q72: Identify which of the following statements is

Q77: Identify which of the following statements is

Q82: How is the gain/loss calculated if a

Q83: Ajax and Brindel Corporations have filed consolidated

Q90: Why would a taxpayer elect to capitalize