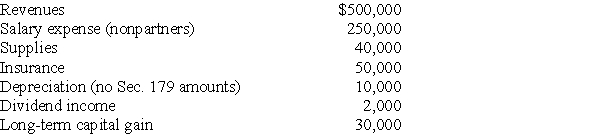

AT Pet Spa is a partnership owned equally by Travis and Ashley.The partnership had the following revenues and expenses this year.Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Definitions:

85th Percentile

A statistical value indicating that 85% of a given population falls below this level, commonly used in various fields such as health, education, and traffic speed analysis.

Middle Childhood

The developmental stage that typically encompasses children from ages 6 to 12, characterized by significant growth in social, cognitive, and emotional areas.

Cognitive Theory

A theory of human development that focuses on how people think. According to this theory, our thoughts shape our attitudes, beliefs, and behaviors.

Computer

An electronic device capable of processing and storing data, and performing tasks according to a set of instructions.

Q7: Identify which of the following statements is

Q13: Richards Corporation reports taxable income exceeding $1.5

Q21: For gift tax purposes,a $14,000 annual exclusion

Q22: Enrico is a self-employed electrician.In May of

Q58: Identify which of the following statements is

Q59: WorldCom created an acquisitions subsidiary (TC Investments

Q72: The primary objective of the federal income

Q77: Alan files his 2016 tax return on

Q119: William and Kate married in 2017 and

Q125: Which of the following statements regarding involuntary