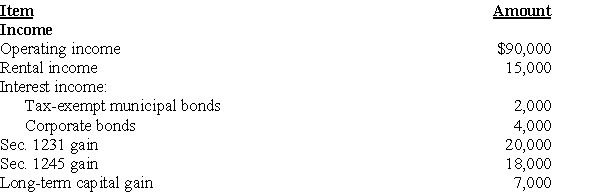

The WE Partnership reports the following items for its current tax year:

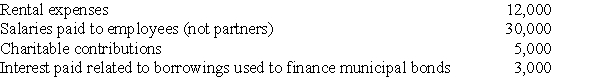

Expenses

Expenses

What is the WE Partnership's ordinary income for the current year?

What is the WE Partnership's ordinary income for the current year?

Definitions:

Producer Surplus

The difference between the amount that producers are willing and able to sell a good for and the actual amount they receive.

Price Elasticity

An indicator of the degree to which demand for a product reacts to variations in its price, showing how sensitive the demand for the good is to price alterations.

Price Discrimination

A method of setting prices where a provider charges different amounts for the same or almost the same items or services to different customers or in various locations.

Monopoly Practices

Business actions by a monopolist aiming to acquire, enhance, or maintain its monopoly power, often to the detriment of consumers and competition.

Q6: A proportional tax rate is one where

Q8: Which of the following items are tax

Q12: Maria,a sole proprietor,has several items of office

Q17: Dusty Corporation owns 90% of Palace Corporation's

Q49: P-S is an affiliated group that files

Q51: When a new business is formed,it must

Q52: The client is a corporation which uses

Q68: Beta Corporation incurs an $80,000 regular tax

Q73: For real property placed in service after

Q102: A retailing business may use the cash-basis