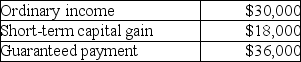

Brent is a general partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

Definitions:

Perseverative Functional Autonomy

A psychological concept referring to repetitive behaviors that continue because they have become habits or have intrinsic value, not because they are driven by the original motives.

Well-Fed Rat

Describes a rat that has been provided with ample food, ensuring its nutritional needs are met, often used in experimental contexts.

Maze

A complex network of paths or passages in which it is difficult to find one's way; metaphorically, it can refer to a complicated situation or problem that one has to navigate or solve.

Perseverative Functional Autonomy

A psychological concept referring to the tendency of certain behaviors and habits to persist beyond their original motivation or context.

Q2: Bruce receives 20 stock rights in a

Q20: Under the MACRS rules,salvage value is not

Q30: In order for an asset to be

Q36: Identify which of the following statements is

Q42: One criterion which will permit a deduction

Q48: What is the tax impact of guaranteed

Q52: A new business is established.It is not

Q71: When computing the accumulated earnings tax,the dividends-paid

Q74: Mike and Jennifer form an equal partnership.Mike

Q111: Victor and Kristina decide to form VK