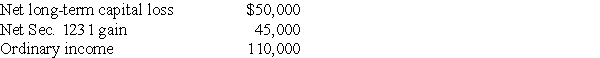

Tracy has a 25% profit interest and a 20% loss interest in the Dupont Partnership.The Dupont Partnership reports the following income and loss items for the current year:

What is Tracy's distributive share?

What is Tracy's distributive share?

Definitions:

First-Class Tickets

Tickets that offer premium services and amenities to passengers, typically at a higher price.

Income

Funds that an individual or business receives, usually in exchange for providing a good or service or through investing capital.

Price

The financial commitment expected, necessary, or made as payment for an article.

Miles

A unit of distance measuring 5280 feet or approximately 1.609 kilometers.

Q3: Remove certain gains,losses,and deductions from each member's

Q3: A partnership must generally use the same

Q30: A plan of liquidation must be reduced

Q36: Yong contributes a machine having an adjusted

Q49: Joan bought a business machine for $15,000.In

Q50: For purposes of determining current E&P,which of

Q63: Sophie owns an unincorporated manufacturing business.In 2017,she

Q65: The unified transfer tax system<br>A)imposes a single

Q88: Alto and Bass Corporations have filed consolidated

Q99: Green Corporation,a closely held operating corporation,reports the