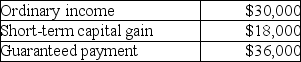

Brent is a general partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

Definitions:

Perception

The process of organizing, identifying, and interpreting sensory information to represent and understand the environment or an event.

Difference Threshold

The minimum difference in physical stimulation required to detect a difference between sensory inputs.

Absolute Threshold

The minimum level of stimulus intensity required for a stimulus to be detected at least 50% of the time by an observer.

Difference Threshold

The minimum difference in stimulation that a person can detect 50% of the time, also known as the "just noticeable difference."

Q6: Under the accrual method of accounting,the two

Q13: Gould Corporation distributes land (a capital asset)worth

Q17: Dusty Corporation owns 90% of Palace Corporation's

Q26: Advance rulings are required for all reorganizations.

Q41: What are the three rules and their

Q42: Horizontal equity means that<br>A)taxpayers with the same

Q43: What are the consequences of a stock

Q54: When the PDQ Partnership formed,it knew it

Q71: In a nontaxable reorganization,the holding period for

Q106: Kate files her tax return 36 days