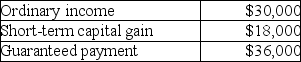

Brent is a limited partner in BC Partnership.His distributive share of partnership income and his guaranteed payment for the year are as follows:  What is his self-employment income?

What is his self-employment income?

Definitions:

Carryover Effect

A phenomenon where the effect of a previous condition or treatment persists and influences outcomes in subsequent conditions or treatments.

Drug Administration

The method by which a drug is taken into the body, including various routes such as oral, intravenous, intramuscular, or topical.

Latin Squares

A statistical design used in experiments that involves arranging treatments in a square matrix to control for two confounding variables simultaneously.

Order Effects

Refers to how the sequence of presenting stimuli or questions can affect the response or performance of participants in an experiment.

Q6: Peach Corporation was formed four years ago.Its

Q8: Current E&P does not include<br>A)tax-exempt interest income.<br>B)life

Q13: What are the tax consequences to Parent

Q30: A consolidated NOL carryover is $52,000 at

Q38: Which of the following taxes is progressive?<br>A)sales

Q68: A separate return year is a corporation's

Q69: Which of the following is not an

Q84: Kevin sold property with an adjusted basis

Q87: The partners of the MCL Partnership,Martin,Clark,and Lewis,share

Q90: Charles Jordan files his income tax return