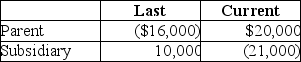

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year the group files a consolidated return. Taxable Income How much of the Subsidiary loss can be carried back to last year?

How much of the Subsidiary loss can be carried back to last year?

Definitions:

Variable Manufacturing Cost

A cost that varies with the level of output production which includes direct materials, direct labor, and variable manufacturing overhead.

Fixed Costs

Costs that remain constant in total regardless of changes in the level of production or sales volume.

Overhead Allocation

The process of distributing indirect costs to products, services, or departments based on relevant allocation bases.

Cost-Based Pricing

A strategy for setting prices where a specific additional amount is added to the product's unit cost to determine the sale price.

Q10: Jared wants his daughter,Jacqueline,to learn about the

Q13: Gould Corporation distributes land (a capital asset)worth

Q13: What are the tax consequences to Parent

Q14: Contracts for services including accounting,legal and architectural

Q19: Rocky is a party to a tax-free

Q24: An installment sale is best defined as<br>A)any

Q30: Zebra Corporation transfers assets with a $120,000

Q36: P and S are members of an

Q72: What are the four general rules that

Q101: Identify which of the following statements is