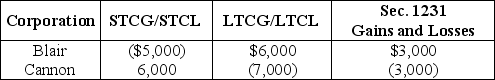

Blair and Cannon Corporations are the two members of an affiliated group.No prior net Sec.1231 losses have been reported by any group member.The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows:  Included in the above totals is $6,000 of long-term capital losses recognized by Cannon on an intercompany transaction.Excluded from the above is a $4,000 Sec.1231 gain originally deferred by Cannon that must be reported by the group in the current year.

Included in the above totals is $6,000 of long-term capital losses recognized by Cannon on an intercompany transaction.Excluded from the above is a $4,000 Sec.1231 gain originally deferred by Cannon that must be reported by the group in the current year.

Which one of the following statements is incorrect?

Definitions:

Yield Curve

A graph of yield to maturity as a function of time to maturity.

Immunization

A strategy in fixed-income portfolio management to shield the portfolio's value from interest rate movements.

Duration

A measure of the sensitivity of the price of a bond or other fixed-income investment to changes in interest rates, often used to assess risk.

Interest-Rate Change

A fluctuation in the cost of borrowing or the return on savings, which can significantly impact financial markets and economic conditions.

Q38: In accounting for research and experimental expenditures,all

Q51: Mia is self-employed as a consultant.During 2017,Mia

Q53: Wills Corporation,which has accumulated a current E&P

Q54: Any Section 179 deduction that is not

Q56: If the business usage of listed property

Q57: Jack Corporation redeems 200 shares of its

Q74: Boxcar Corporation and Sidecar Corporation,an affiliated group,reports

Q74: Bert,a self-employed attorney,is considering either purchasing or

Q83: Property is generally included on an estate

Q101: List the steps in the legislative process