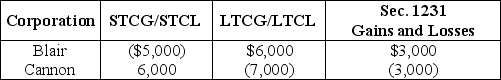

Blair and Cannon Corporations are members of an affiliated group.No prior net Sec.1231 losses have been reported by any group member.The two corporations report consolidated ordinary income of $100,000 and gains and losses from property transactions as follows.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Cross-Cultural Training

Educational programs designed to prepare individuals to interact effectively with those from different cultural backgrounds, often focusing on communication styles and social norms.

Nonverbal Gestures

Forms of communication without the use of spoken language, including body language, facial expressions, and other visual cues.

Foreign Assignments

Tasks or projects assigned to an employee in a location outside their home country, typically for business expansion or operational reasons.

Communication Strategy Continuum

A range of strategic options available for communicating, from fully controlled and direct methods to more open and indirect approaches.

Q9: Discuss the advantages and disadvantages of a

Q47: Which of following generally does not indicate

Q49: Matt and Joel are equal partners in

Q55: Blueboy Inc.contributes inventory to a qualified charity

Q55: When a taxpayer leases an automobile for

Q62: Bao had investment land that he purchased

Q69: Jack purchases land which he plans on

Q79: Kyle sold land on the installment basis

Q101: The stock of Cooper Corporation is 70%

Q106: Electing large partnership rules differ from other