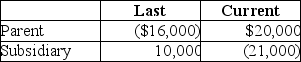

Parent and Subsidiary Corporations form an affiliated group.Last year,the initial year of operation,Parent and Subsidiary filed separate returns.This year the group files a consolidated return. Taxable Income How much of the Subsidiary loss can be carried back to last year?

How much of the Subsidiary loss can be carried back to last year?

Definitions:

Incentivize

To provide motivation or encouragement through rewards or benefits, aiming to promote certain behaviors or actions.

Insurable Interest

A principle that requires an individual to have a stake in the safety or preservation of the insured object against loss or damage.

Financial Benefit

An economic advantage or gain received, such as income, dividends, or appreciation in asset value.

Fair Market Value

Fair market value is the price at which a willing buyer and a willing seller, both having reasonable knowledge of the relevant facts, would engage in a transaction.

Q8: Gifts made during a taxpayer's lifetime may

Q14: Arthur pays tax of $5,000 on taxable

Q31: Regressive tax rates decrease as the tax

Q38: On July 1,in connection with a recapitalization

Q57: ABC Partnership distributes $12,000 to partner Al.Al's

Q63: Susan owns 150 of the 200 outstanding

Q63: Which of the following statements is incorrect

Q83: Identify which of the following statements is

Q83: Yee manages Huang real estate,a partnership in

Q100: The U.S.production activities deduction is based on