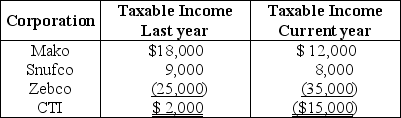

Mako and Snufco Corporations are affiliated and have filed consolidated returns for the past three years.Mako acquired 100% of Zebco stock on January 1 of last year,the date of Zebco's formation.Mako,Snufco,and Zebco,who have filed consolidated returns for last year and the current year,report the following taxable incomes.  The $15,000 consolidated NOL reported in the current year

The $15,000 consolidated NOL reported in the current year

Definitions:

Raw Materials

The basic materials from which products are made, typically unprocessed or minimally processed before being used in manufacturing processes.

Contribution Margin

The difference between sales revenue and variable costs, indicating how much revenue contributes to covering fixed costs.

Fixed Costs

Expenses that do not change in total regardless of the level of production or sales activity, such as rent, salaries, and insurance.

Marginal Costs

The additional cost incurred by producing one extra unit of a product or service.

Q11: The look-back interest adjustment involves the<br>A)calculation of

Q47: Identify which of the following statements is

Q51: Identify which of the following statements is

Q51: All of the stock of Hartz and

Q62: Barnett Corporation owns an office building that

Q63: Susan owns 150 of the 200 outstanding

Q67: In a taxable distribution of stock,the recipient

Q70: Identify which of the following statements is

Q91: Harrison acquires $65,000 of 5-year property in

Q94: Charlene and Dennis each own 50% of