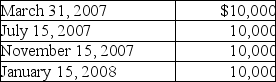

Sandy,a cash method of accounting taxpayer,has a basis of $46,000 in her 500 shares of Newt Corporation stock.She receives the following distributions as part of Newt's plan of liquidation.  The amount of the final distribution is not known on December 31,2007.What are the tax consequences of the distributions?

The amount of the final distribution is not known on December 31,2007.What are the tax consequences of the distributions?

Definitions:

Discount Consumer Electronics

Retail or online stores offering electronic goods at reduced prices, typical of items that are surplus, refurbished, or off-season.

Storage Racks

Shelving units or frameworks designed for the organized storage of items, goods, or materials in both residential and commercial spaces.

Price Fixing

Price Fixing is an illegal practice where competing companies agree to set the same price for their products or services, eliminating competition.

Conspiracy

A secret plan by a group to do something unlawful or harmful, or the belief in such secret schemes.

Q9: Poppy Corporation was formed three years ago.Poppy's

Q15: Axle Corporation acquires 100% of Drexel Corporation's

Q25: Identify which of the following statements is

Q52: Identify which of the following statements is

Q89: Last year,Trix Corporation acquired 100% of Track

Q92: Identify which of the following statements is

Q97: Azar,who owns 100% of Hat Corporation,transfers land

Q100: Corporations recognize gains and losses on the

Q105: Liquidation and dissolution have the same legal

Q117: Business assets of a sole proprietorship are