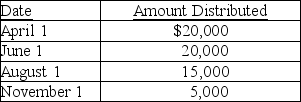

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Unconditioned Stimulus

A stimulus that naturally triggers a reflexive response without any prior learning.

Salivation

The secretion of saliva, often triggered reflexively by the anticipation or presence of food as a part of the digestive process.

Blood Sugar

The concentration of glucose in the blood, crucial for energy provision in the body.

Wagner's SOP Model

A theoretical model in psychology that explains how stimuli are processed into memories, focusing on the processes of acquisition, storage, and retrieval.

Q14: Which of the following items are adjustments

Q15: Identify which of the following statements is

Q16: Which of the following intercompany transactions creates

Q20: S corporations must allocate income to shareholders

Q27: Identify which of the following statements is

Q49: What is the effect of the two-pronged

Q68: Rock Corporation acquires all of the assets

Q78: Identify which of the following statements is

Q78: Strong Corporation is owned by a group

Q99: Bat Corporation distributes stock rights with a