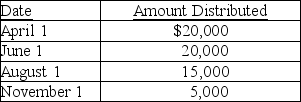

Exit Corporation has accumulated E&P of $24,000 at the beginning of the current tax year.Current E&P is $20,000.During the year,the corporation makes the following distributions to its sole shareholder who has a $22,000 basis for her stock.  The treatment of the $15,000 August 1 distribution would be

The treatment of the $15,000 August 1 distribution would be

Definitions:

Expressive Roles

Social roles focused on emotional support, nurturing, and maintaining relationships within families or groups.

Toddlers & Tiaras

A reality television show focusing on the families and children involved in child beauty pageants.

Sexualization

The process or actions that attribute sexual characteristics to an individual, group, or activity unnecessarily or inappropriately.

Women Engineering Students

Female students who are pursuing academic degrees in engineering, a field historically dominated by men, aiming to increase diversity and gender balance in STEM fields.

Q38: Walter,who owns all of the Ajax Corporation

Q45: Dragon Corporation reports a distribution on its

Q62: Jason and Jon Corporations are members of

Q63: Pedro,a nonresident alien,licenses a patent to a

Q64: Identify which of the following statements is

Q79: When computing the accumulated earnings tax,which of

Q84: Webster,who owns all the Bear Corporation stock,purchases

Q91: How long does a taxpayer have to

Q94: Jackson and Tanker Corporations are members of

Q94: Charlene and Dennis each own 50% of