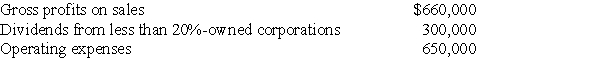

Carter Corporation reports the following results for the current year:

a)What is Carter Corporation's taxable income for the current year?

a)What is Carter Corporation's taxable income for the current year?

b)How would your answer to Part (a)change if Carter's operating expenses are instead $700,000?

c)How would your answer to Part (a)change if Carter's operating expenses are instead $760,000?

Definitions:

Split-up

A corporate action where a company divides its business operations into two or more independently run companies.

Complementary Resources

Assets or inputs that when used together enhance the value or productivity of each other in the production process.

Corporate Restructurings

The process of significantly changing a company's operations, structure, or financial setup, often to improve profitability or efficiency.

Common Stock

A form of corporate equity ownership, a type of security that represents ownership in a corporation and gives holders voting rights.

Q18: Anton,Bettina,and Caleb form Cage Corporation.Each contributes appreciated

Q18: Which of the following communications between an

Q33: Identify which of the following statements is

Q38: The accumulated earnings tax is imposed at

Q55: Blueboy Inc.contributes inventory to a qualified charity

Q62: Perry,a U.S.citizen,is transferred by his employer to

Q72: Identify which of the following statements is

Q80: U)S.Corporation owns 45% of the stock of

Q91: What is the benefit of the 65-day

Q111: Checkers Corporation has a single class of