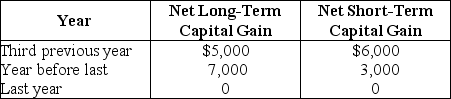

Lass Corporation reports a $25,000 net capital loss this year.The corporation reports the following net capital gains during the past three years.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss,if any,available as a carryforward.

Determine the amount of net capital loss carried back to each preceding tax year and the amount of capital loss,if any,available as a carryforward.

Definitions:

Voluntary Participation

The principle that individuals choose to participate in an activity or research without coercion.

Operationalization Process

The procedure of defining the measurement of a phenomenon that is not directly measurable, by aligning it with an observable operation, quality, or quantity.

Concepts

Fundamental ideas or categories that help to organize thought and serve as the building blocks for more complex theories or knowledge.

Variables

Elements or features that can vary or change within a study, experiment, or statistical analysis, impacting the outcome or results.

Q20: Jack Corporation is owned 75% by Sherri

Q34: Mountaineer,Inc.has the following results: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1258/.jpg" alt="Mountaineer,Inc.has

Q36: A simple trust has the following results:<br>

Q39: Which of the following is an advantage

Q43: Courtney Corporation had the following income and

Q45: Liquidation of a subsidiary corporation - The

Q53: Identify which of the following statements is

Q83: Marie owns one-half of the stock of

Q91: Income derived from the sale of merchandise

Q103: Identify which of the following statements is