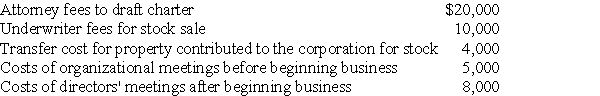

The following expenses are incurred by Salter Corporation when it is organized on July 1:

Salter commenced business on September 8.What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Salter commenced business on September 8.What is the maximum amount of organizational expenditures that can be deducted by the corporation for its first tax year ending December 31?

Definitions:

Milgram

Refers to Stanley Milgram, a psychologist known for his research on obedience to authority, notably his controversial experiment in the 1960s.

Agricultural Societies

Societies that rely on agriculture as their primary means for support and sustenance, cultivating plants and domesticating animals.

Food Production

The processes involved in the creation of food items, including agriculture, farming, and manufacturing.

Material Production

The process of creating goods and services through the combination of human labor, materials, and technology.

Q22: Pete has reported a tax liability of

Q29: In a complete liquidation,a liability assumed by

Q32: Payment Corporation has accumulated E&P of $19,000

Q36: Little Corporation uses the accrual method of

Q36: Identify which of the following statements is

Q63: Which of the following is not subject

Q65: Define the term "nonresident alien" and discuss

Q71: Perch Corporation has made paint and paint

Q114: Vanda Corporation sold a truck with an

Q115: Martin operates a law practice as a