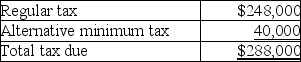

Grant Corporation is not a large corporation for estimated tax purposes and reports on a calendar-year basis.Grant expects the following results:  Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

Grant's tax liability for last year was $240,000.Grant's minimum total estimated tax payment for this year to avoid a penalty is

Definitions:

Labor Force

consists of all the people who are of working age, able and willing to work, and actively seeking employment or are currently employed.

Cost of Living

The financial requirement to maintain a specific lifestyle, covering essential costs like accommodation, nutrition, taxes, and medical care.

Adjustment Agreement

A contract or understanding that allows for modifications to be made to the terms of an agreement or deal, adapting to new conditions or information.

COLA

Cost of Living Adjustment, an increase in income to keep up with living expenses, often applied to salaries and benefits to offset inflation.

Q7: Identify which of the following statements is

Q14: Joyce passed away on January 3 while

Q24: Joker Corporation owns 80% of Klue Corporation.Joker

Q31: Identify which of the following statements is

Q39: Describe the tier system for trust beneficiaries.

Q53: Proceeds of a life insurance policy payable

Q64: The maximum failure to file penalty is

Q73: Sukdev Basi funded an irrevocable simple trust

Q75: Discuss the estimated tax filing requirements for

Q98: Nikki exchanges property having a $20,000 adjusted