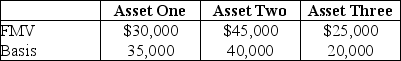

Max transfers the following properties to a newly created corporation for $90,000 of stock and $10,000 cash in a transaction that qualifies under Sec.351.  Max's recognized gain is

Max's recognized gain is

Definitions:

Swinging Couples

Couples who engage in consensual exchanges of partners for sexual activities within certain agreed boundaries.

Initiated

To begin, set going, or originate something for the first time.

Extramarital Sex

Sexual activities engaged in by a married person with someone other than their spouse.

Pleasurable

Relating to or providing a deep sense of satisfaction or enjoyment.

Q11: Bread Corporation is a C corporation with

Q13: Gould Corporation distributes land (a capital asset)worth

Q51: Crossroads Corporation distributes $60,000 to its sole

Q56: Any losses on the sale of Section

Q56: Under a plan of complete liquidation,Coast Corporation

Q58: A terminable interest is one that ceases

Q60: Two corporations are considered to be brother-sister

Q94: Reversionary interests in publicly traded stocks included

Q120: Chambers Corporation is a calendar year taxpayer

Q124: Which of the following items indicate that