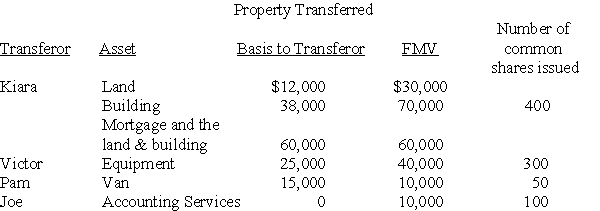

On May 1 of the current year,Kiara,Victor,Pam,and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000,respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara,Victor,Pam,Joe,and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Price Elasticity

Measures how much the quantity demanded of a good changes in response to a change in its price.

Coefficient

A numerical or constant quantity placed before and multiplying the variable in an algebraic expression.

Inelastic

Describing a situation where the demand for a good or service is relatively unaffected by changes in its price.

Essential Consumption

The purchase and use of goods and services that are considered necessary for basic living and well-being.

Q2: Wind Corporation is a personal holding company.Its

Q4: How does a taxpayer determine if "substantial

Q14: When appreciated property is distributed in a

Q33: Ball Corporation owns 80% of Net Corporation's

Q40: Frans and Arie own 75 shares and

Q44: Identify which of the following statements is

Q64: U.S.Corporation owns 45% of the stock of

Q71: When computing the accumulated earnings tax,the dividends-paid

Q82: Which of the following items is a

Q104: Identify which of the following statements is