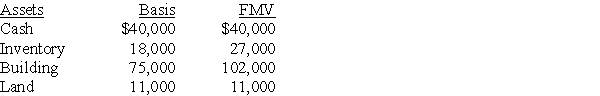

David sells his one-third partnership interest to Diana for $60,000 when his basis in the partnership interest is $48,000.On the date of sale,the partnership has no liabilities and the following assets:

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

The building is depreciated on a straight-line basis.What tax issues should David and Diana consider with respect to the sale transaction?

Definitions:

Collusive Agreements

Secret or illegal cooperation or conspiracy, especially between firms, to deceive or defraud others, restrict competition, or fix prices.

Price Leadership Model

A market structure where one leading firm sets the price for its product and the other firms in the market follow suit, adjusting their prices accordingly.

Nonprice Competition

A strategy where businesses compete on factors other than price, such as product quality, service, or brand reputation.

Shrinking PC Market

A trend indicating a decline in the demand or sales of personal computers, often due to shifts toward mobile devices or other technologies.

Q8: One psychological bias that can lead to

Q9: How does the balance of power between

Q17: What are some interpersonal strategies for effectively

Q19: When considering a person's reputation in negotiation,which

Q31: Sally is a calendar-year taxpayer who owns

Q48: Tia funds an irrevocable trust with $100,000,naming

Q56: Small case procedures of the U.S.Tax Court

Q79: A jury trial is permitted in the<br>A)U)S.District

Q88: Listed stocks are valued at their closing

Q104: Identify which of the following statements is