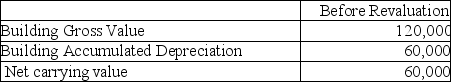

Smith Inc wishes to use the revaluation model for this property:

The fair value for the property is $150,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

Definitions:

Explanatory Style

The manner in which individuals habitually explain the causes of events, which can influence their motivation and emotional states.

Laid Off

Refers to the termination of employment due to company downsizing or economic difficulties, not because of individual performance issues.

Extraversion

A personality dimension that describes the extent to which a person is outgoing, sociable, and seeks stimulation and the company of others.

Dying Earlier

The phenomenon of experiencing a shortened lifespan, often due to factors such as lifestyle, environment, genetic predispositions, or health conditions.

Q15: The electron configuration of a Co<sup>3+ </sup>ion

Q19: Which item is an example of real

Q31: Which of these ions is most likely

Q41: When atoms of beryllium-9 are bombarded with

Q62: Calculate the cell emf for the

Q91: What impairment,if any,exists on these product lines?<br><img

Q96: The following nuclear equation is correctly balanced.

Q99: Which of the following is a not

Q115: When can inventory be overstated under the

Q118: What is the meaning of "units-of-production method"?<br>A)The