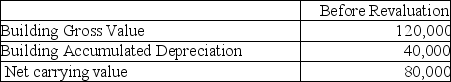

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $40,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

Definitions:

Q9: A machine was acquired on January 1,2018

Q16: Explain how non-current assets that are held

Q22: A molecule or atom that accepts an

Q28: Which statement is not correct?<br>A)Impairment testing is

Q29: Protactinium-234 has a half-life of 1 minute.How

Q42: Company Ten purchased land for $400,000 during

Q54: Write the chemical formula of magnetite.

Q76: On January 1,2017,a company paid $100,000 to

Q84: Fish Corp.purchases a $500,000 face value bond

Q121: Consider the reaction Hg<sup>2+</sup>(aq)+ Hg(l) <img