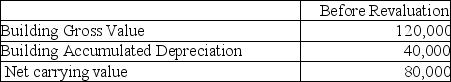

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much depreciation expense would be recorded in the year subsequent to the revaluation?

Definitions:

Competitive Advantage

A condition that allows a company or country to produce goods or services at a lower price or in a more desirable fashion for customers.

Consulting Company

A business that provides expert advice to other organizations or individuals in a professional field.

Developing Contacts

The process of building and maintaining relationships with people who could be helpful professionally or personally.

Informal Mentoring

A casual, non-structured mentoring relationship focusing on the mentee's growth and learning through the mentor's experiences and advice.

Q10: Safe Investment Company (SIC)began operations on January

Q16: The secondary structure of a protein is

Q22: The only stable isotope of iodine is

Q49: Which of the following is correct with

Q67: In the complex ion [Co(en)<sub>2</sub>Br<sub>2</sub>]<sup>+</sup>, the oxidation

Q73: What costs are not included in the

Q87: Which inventory method provides the highest quality

Q104: Super Control Group has the following investments:<br>

Q107: Will the method of depreciation affect the

Q132: Which statement best depicts the inventory cost