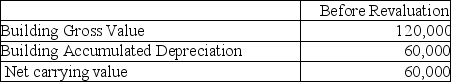

Smith Inc wishes to use the revaluation model for this property:

The fair value for the property is $150,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Investor

An individual or entity that allocates capital with the expectation of receiving financial returns.

Nominal Interest Rate

The interest rate as stated on a loan or financial product, not taking into account inflation or fees.

Annual Compounding

The method of accruing interest on the main amount of a deposit or loan annually.

Semi-annual Compounding

The process of calculating interest where the accumulated interest is added to the principal sum twice a year.

Q4: Historic Pieces Inc.purchased equipment on January 1,2018

Q7: AccountingPro purchased equipment on January 1,2015 for

Q20: In the complex ion [ML<sub>6</sub>]<sup>n+</sup>, M<sup>n+</sup> has

Q25: When liquid phosphorus trichloride reacts with water,

Q27: What is the meaning of "net realizable

Q28: Which one of these molecules could not

Q40: Chlorine gas is prepared commercially by<br>A)electrolysis of

Q48: The formula CH<sub>3</sub>CH<sub>2</sub>CH<sub>2</sub>CH=CH<sub>2</sub> represents<br>A)an alkane.<br>B)a cycloalkane.<br>C)an alkene.<br>D)an

Q59: Mirvish Limited invests in short term investments.The

Q87: Polar Sky Railway (PSR),a transportation company,has substantial