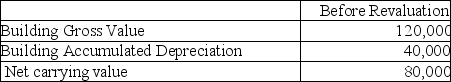

Wallace Inc wishes to use the revaluation model for this property:

The fair value for the property is $60,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Q1: Hydrogen plays an important role in many

Q3: Decay of lutetium-167 by electron capture yields<br>A)ytterbium-167.<br>B)lutetium-166.<br>C)thulium-163.<br>D)tantalum-171.<br>E)hafnium-167.

Q13: Forest Company paid $38,000,000 for a warehouse

Q14: McGyer Limited invests its excess cash in

Q20: What factor will not affect the estimated

Q25: In n-type semiconductors<br>A)the energy gap between the

Q79: Which statement is correct?<br>A)Agricultural activity relates to

Q109: Based on the following information,what is the

Q115: Calculate the minimum voltage required for

Q137: Which statement is correct about non-strategic financial