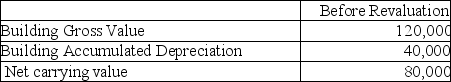

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $40,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Pharmacist

A person licensed to prepare and dispense drugs and prescriptions.

Disclosure

The provision of information needed for the parties to make an informed decision.

Voluntariness

The client’s right to come to a decision without force, coercion, or manipulation from others.

Consent

Giving permission for something to happen or agreeing to do something, often used in medical contexts to refer to patients agreeing to receive treatment.

Q9: Three means used to concentrate ores are

Q22: The compound that has a triple bond

Q26: Which of the following is correct with

Q26: Hydrogen plays an important role in many

Q37: Wilson Inc wishes to use the revaluation

Q42: Company Ten purchased land for $400,000 during

Q55: Kings has a 40% joint operation interest

Q56: Wallace Inc wishes to use the revaluation

Q86: When an aqueous solution of AgNO<sub>3</sub> is

Q130: Will H<sub>2</sub>(g)form when Ag is placed in