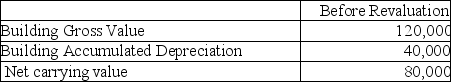

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Australia

A country and continent surrounded by the Indian and Pacific oceans, known for its unique wildlife, landscapes, and major cities like Sydney and Melbourne.

Isolated

To be set apart or separated from others, often referring to geographical, social, or molecular contexts.

Homologous Structures

Anatomical features in different organisms that, despite potential differences in function, indicate common ancestry.

Common Ancestry

The concept that different species share a common ancestor, a fundamental principle in evolutionary biology.

Q12: Which of these substances is the active

Q20: In the complex ion [ML<sub>6</sub>]<sup>n+</sup>, M<sup>n+</sup> has

Q33: Alkali metal hydrides are very reactive with

Q33: Grover Inc wishes to use the revaluation

Q48: Assume that a company has spent $1

Q57: GoodResources incurred the following costs:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1320/.jpg" alt="GoodResources

Q68: Soorya Resources incurred the following costs:<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1320/.jpg"

Q72: Tritium is a radioisotope of hydrogen

Q87: Polar Sky Railway (PSR),a transportation company,has substantial

Q137: Many different ways have been proposed to