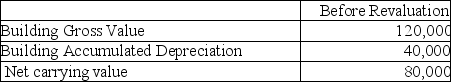

Wilson Inc wishes to use the revaluation model for this property:

The fair value for the property is $140,000.Using straight-line depreciation and assuming that the property has a remaining depreciable life of 5 years,how much would be booked to accumulated depreciation in the year subsequent to the revaluation?

Definitions:

Sensorimotor Stage

The first phase in Piaget's theory of cognitive development, where infants explore and understand the world through sensory experiences and motor actions.

Goal Oriented

Being focused on setting and achieving specific objectives or targets.

Patty-cake

A popular hand-clapping game played between a parent and child, often involving simple, coordinated movements to a rhythmic chant.

Q10: Which criteria under IAS 38 would be

Q11: On January 1,2017,a company paid $100,000 to

Q11: Which of these statements does not describe

Q11: Complete and balance the nuclear equation <img

Q14: Bidentate and polydentate ligands are also called

Q16: How many moles of silver metal are

Q16: Explain how non-current assets that are held

Q23: The half-reaction that should occur at

Q70: Explain the meaning of product costs and

Q113: Which statement is correct?<br>A)Vines are biological assets