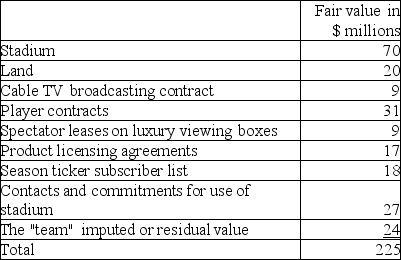

A professional sports team and related items (including a stadium)were bought by an exceedingly wealthy investor and sports fan.The negotiated price was $225,000,000.Details of what was purchased and the agreed fair values are as follows:

The team has been less than successful in its professional sports league and has been recording losses of $1,000,000 to $8,000,000 per year on its audited financial statements for the past five years.It was these losses that prompted the last owner to sell the team and related assets.

Required:

a.There are several identifiable intangible assets noted on the list.Group these assets into three classes,being those that are

(i)easily measurable and identifiable;

(ii)reasonably measurable and identifiable;and

(iii)very difficult to measure and identify.

For each group,what common quality or feature of these items distinguishes their classification?

b.While all the items can be assigned a value,would you capitalize all these amounts?

Explain your conclusion.

Definitions:

Long-run Average Total Cost

The per unit cost of production when all inputs, including both fixed and variable costs, are adjusted to their optimal levels over time.

Automobile Manufacturing

The industry and process involved in designing, producing, marketing, and selling motor vehicles.

Ford Motor Company

An American multinational automaker founded by Henry Ford, known for revolutionizing the automobile industry.

Constant Returns to Scale

A condition where increasing all inputs by the same proportion results in an increase in output by that same proportion.

Q6: The ion [Co(NH<sub>3</sub>)<sub>6</sub>]<sup>2+</sup> is octahedral and high

Q7: The primary structure of a protein refers

Q17: Which one of these materials is a

Q23: What type of polymer is represented by

Q67: In the complex ion [Co(en)<sub>2</sub>Br<sub>2</sub>]<sup>+</sup>, the oxidation

Q70: Based on the following information,what is the

Q102: Identify the two criteria for classifying an

Q107: What is "agricultural activity"?<br>A)The harvested product of

Q112: Explain how a manufacturing company can manipulate

Q122: Which statement is not correct about overhead?<br>A)Fixed