The following transactions occurred in fiscal 2018:

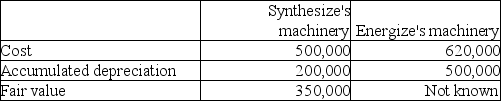

• Synthesize Inc.exchanged machinery with Energize Corp.

• Synthesize Inc.purchased equipment by signing a 5 year non-interest bearing note payable for $200,000.The implicit rate of interest was 5%.

• Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Definitions:

Pc

Typically refers to a personal computer, a general-purpose device for individual use, capable of running software applications.

Sig

A term used in prescriptions, derived from the Latin "signatura," instructing patients on how to take their medication.

Milliliter

A unit of volume equal to one-thousandth of a liter, commonly used in measuring liquid quantities.

Q2: Star Corp.purchases a $100,000 face value bond

Q2: Wilson Inc wishes to use the revaluation

Q3: In 2018,New Wave Inc.(NW)set up a new

Q7: AccountingPro purchased equipment on January 1,2015 for

Q13: Complete and balance the nuclear equation <img

Q17: Bromination of benzene (C<sub>6</sub>H<sub>6</sub>), an aromatic compound,<br>A)occurs

Q29: What is the oxidation number of cobalt

Q53: Which statement is not correct about the

Q77: A $50,000 sale transaction is made with

Q99: Which statement best explains the FIFO cost