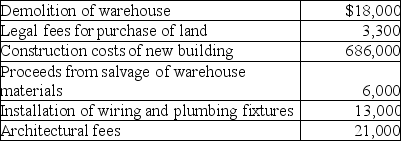

Grape Company (GC)had been renting an office building for several years.On January 1,2019,GC decided to have a new office building constructed.On that date,it acquired land with an abandoned warehouse on it for $350,000.Other costs included the following:

Required:

a.Calculate at what amount GC should record the (i)land and (ii)building.

b.Assume that the building was completed and occupied on December 31,2019.It has an estimated useful life of 40 years,with residual value of $140,000.Calculate depreciation for 2020 using (i)the straight-line method and (ii)the double declining balance method.

c.Assume that management decided to use straight-line depreciation for the building.By 2023 GC had

grown considerably and needed to relocate for more space;it sold the land and building to Macaw Company on July 1,2023 for $1,350,000.Assume depreciation expense has already been recorded for the first six months of the year (Jan.1,2023 to June 30,2023).Prepare all journal entries required relating to the land and building accounts on July 1,2023.

Definitions:

Rales

Abnormal crackling or rattling sounds heard in the lungs with a stethoscope, indicative of fluid in the alveoli due to conditions like pneumonia.

Rhonchi

Coarse rattling respiratory sounds somewhat similar to snoring, usually caused by obstruction or secretion within the larger airways.

Crackles

A type of abnormal lung sound heard through a stethoscope, indicating fluid in the air spaces of the lungs, often associated with heart or lung conditions.

Abdominal Palpation

A hands-on examination technique used by healthcare providers to assess organs and structures within the abdomen.

Q7: What is the meaning of "joint control"?<br>A)Ability

Q23: A large piece of earth-moving equipment was

Q26: Assume that ending inventory in fiscal 2016

Q42: Amides are synthesized from two classes of

Q51: Amacon Corporation has the following investments at

Q69: Which statement is correct?<br>A)In the exploration and

Q94: Which statement about internal controls over cash

Q95: Kings has a 40% joint operation interest

Q96: A company has fixed production overhead costs

Q105: Explain how non-current assets that are part