The following transactions occurred in fiscal 2018:

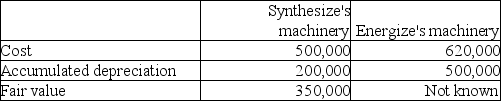

• Synthesize Inc.exchanged machinery with Energize Corp.

• Synthesize Inc.purchased equipment by signing a 5 year non-interest bearing note payable for $200,000.The implicit rate of interest was 5%.

• Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Definitions:

National Credit Cards

Credit cards that are accepted within a specific country, which might not be valid for international transactions.

Credit Card Companies

Businesses that issue credit cards and facilitate credit transactions between consumers and merchants.

Receivables Businesses

Companies that specialize in managing and collecting accounts receivable on behalf of other businesses.

Trade Receivables

Trade receivables, also known as accounts receivable, are amounts owed to a business by its customers for goods or services delivered on credit.

Q1: Which statement is not correct?<br>A)Under the successful

Q5: Other comprehensive income includes which of the

Q36: What is the meaning of "historical cost"?<br>A)The

Q55: Fitness Machines reported cash sales of $50,000,credit

Q73: SuperIdeas Corp,a publicly accountable entity,incurred the following

Q77: Explain why a company should allocate revenue

Q81: XYZ Company estimates their allowance for doubtful

Q112: Wilson Inc wishes to use the revaluation

Q125: On January 1,2017,The Freedom Company purchased a

Q127: Explain how items of inventory should be