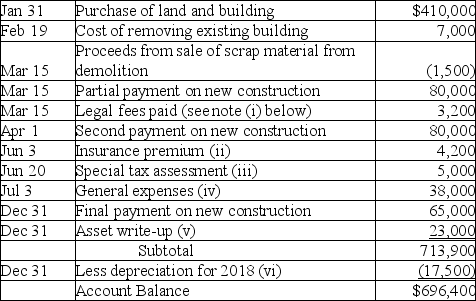

Zach Co.Ltd.was incorporated on January 2,2018,but was unable to begin their manufacturing operations immediately.The new factory facilities became available for use on July 1,2018.During the start-up period,the company provisionally used a "Land and Factory Building" account to record the following transactions,in chronological order:

Additional info

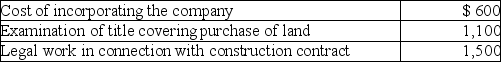

i.Legal fees of $3,200 covered the following:

ii.Insurance covered the building for a one-year term beginning April 1,2018.

iii.The special tax assessment covered repaving the street in front of the building.

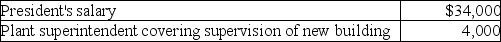

iv.General expenses covered the following for the period January 2,2018 to June 30,2018.

v.The board of directors increased the value of the building by $23,000,believing that such an increase was justified to reflect the current market at the time the building was completed;Retained Earnings was credited for this amount.

vi.Engineers estimate the useful life of the building to be 40 years.The company believes that the declining balance method at a 5% rate is appropriate.The company's policy for new PPE is to depreciate the assets according to the time available for use in the fiscal year,rounded to the closest month.

Required:

Prepare entries to reflect correct land,factory building,and accumulated depreciation accounts at December 31,2018.Round values to the nearest dollar,if necessary.

Definitions:

Adopted

Relates to having chosen or accepted something, often referring to a legal process where someone chooses to become the parent of a child who is not biologically theirs.

Psychosocial Development

A theory that describes the stages of psychological and social development through which individuals pass from infancy to adulthood.

Identity

A concept referring to a person's perception of self, in terms of distinguishing characteristics, values, and social relations that give individuals a sense of who they are.

Role Confusion

A situation in which an adolescent does not seem to know or care what his or her identity is. (Sometimes called identity diffusion or role diffusion.)

Q6: Which statement is correct about cost allocation

Q27: Fruit Valley Inc.reported cash sales of $250,000,credit

Q33: Which of these is the systematic name

Q37: Wilson Inc wishes to use the revaluation

Q60: Assume that a purchase invoice for $1,000

Q67: A professional sports team and related items

Q69: Copper can be separated from iron in

Q76: On January 1,2017,a company paid $100,000 to

Q98: What is the meaning of "straight-line method"?<br>A)The

Q107: Using the following cost information regarding finished