In December 2019,Bea,the owner of Walnut Corp,paid for a parcel of land along with a warehouse on behalf of Walnut,the registered owner of the property,for a total cost of $1,500,000.Bea also paid a real estate commission of $40,000 and legal fees of $10,000 in connection with this purchase,plus $30,000 for the demolition of the warehouse.Walnut will reimburse Bea for these costs in January 2020 and will begin construction of an office building on this land.Prior to the purchase,the land and warehouse were appraised at $900,000 and $600,000,respectively.

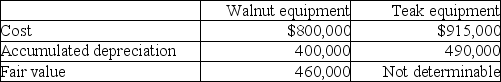

On December 31,2019,Walnut Corp and Teak Corp.exchanged equipment.The exchange met the test for commercial substance for accounting purposes.Details of the carrying values and fair values of the equipment on the date of the exchange were as follows:

On October 1,2019,Walnut purchased some land by signing a three-year non-interest-bearing note payable for $500,000.Walnut pays interest at the rate of 12% on other loans and was pleased to get a non-interest-bearing note payable on this deal.

Required:

Prepare the required journal entries for these transactions,as well as any related year-end adjustments.Ignore income taxes.Round all values to the nearest dollar,if necessary.

Definitions:

Group Norms

The unwritten rules and expectations that guide behavior within a group, influencing how members act, communicate, and interact.

Social Stereotypes

Widely held beliefs or oversimplifications about the traits, behaviors, and characteristics of certain groups or categories of people.

Role Congruity Theory

Mainly applied to the gender gap in leadership – because social stereotypes of women are inconsistent with people’s schemas of effective leadership, women are evaluated as poor leaders.

Gender Gap

The disparity in outcomes or attitudes between men and women, often observed in political, economic, or social contexts.

Q2: McGraw Motors both sells and leases vehicles.With

Q10: Which of the following methods of revenue

Q14: Khanna Inc.had the following transactions,information and balances

Q29: Which criteria under IAS 38 would be

Q50: Which statement is correct?<br>A)Under IFRS,research costs must

Q66: Karin-Jones Ltd.reported an opening balance of $1,712,000

Q78: The adjusted market assessment approach which involves

Q79: On April 1,2019,Omega Company paid $15,000 for

Q92: Assume that a purchase invoice for $1,000

Q131: What should an investment in a debt