The following transactions occurred in fiscal 2018:

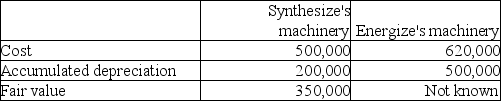

• Synthesize Inc.exchanged machinery with Energize Corp.

• Synthesize Inc.purchased equipment by signing a 5 year non-interest bearing note payable for $200,000.The implicit rate of interest was 5%.

• Synthesize received a government grant of $10,000 to help purchase the equipment.

Required:

a)Assuming the machinery exchange has commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

b)Assuming the machinery exchange does not have commercial substance,prepare the required journal entries for the exchange for both Synthesize and Energize.

c)Prepare the required journal entry to record the purchase of the equipment purchased by the non-interest bearing note.

d)Prepare the required journal entries to record the government grant using both the gross method and the net method.

Definitions:

Acknowledgments Section

A part of a document or book where the author expresses gratitude to those who contributed to the work.

Lab Report

A detailed document describing the process, results, and conclusions of a laboratory experiment.

Funding

The act of providing financial resources, typically in the form of money, or other values such as effort or time, to finance a need, program, and project, usually by an organization or government.

Crafted Argument

A well-thought-out and structured presentation of reasons and evidence to support a particular position or viewpoint.

Q14: Poly(vinyl chloride)results from the polymerization of <img

Q16: Explain how non-current assets that are held

Q18: Accounting standards provide for a variety of

Q36: Calculate the binding energy per nucleon of

Q55: Kings has a 40% joint operation interest

Q60: The following entry was recorded by Williams

Q63: Which factor will affect the estimated useful

Q108: What issue does NOT relate to the

Q112: What amount will be included in "cash

Q114: Identify if the following investments meet the