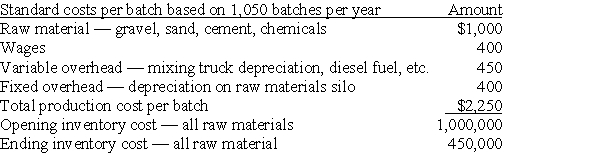

Muscle Concrete mixes concrete and trucks it to construction sites.The company uses a standard costing system for the batches of concrete produced.The company has a fleet of 10 mixing trucks,each of which goes on three runs per day,350 days per year under normal circumstances.The standard costs are as follows:

During 2017,the company received an unusually large order for a big construction project.As a result,Muscle Concrete had to extend its operating hours and days,temporarily increasing output to 1,250 batches for the year.The company used the first-in,first-out cost flow assumption.Actual variable costs approximated standard costs per batch.Depreciation rates established at the beginning of the year remain valid for the year.

Required:

Determine the amount of cost of goods sold for 2017.

Definitions:

Long-Term Liabilities

Financial obligations of a company that are due beyond one year, such as bonds payable, long-term loans, and lease liabilities.

Known Current Liabilities

Short-term financial obligations that are recognized and recorded, expected to be settled within one year or within the normal operating cycle.

Liabilities

Financial obligations or debts that a company owes to others, which must be settled over time through the transfer of economic benefits including money, goods, or services.

Contingent Liabilities

Contingent liabilities are potential liabilities that may occur depending on the outcome of a future event.

Q1: Which statement best explains the percentage of

Q15: Wright Now Limited (WNL)was incorporated on January

Q22: Explain what financial assets are,how they differ

Q25: Based on the following information,what is the

Q55: Praguian Company built two similar buildings.Each building

Q58: Jackie Co.'s allowance for doubtful accounts was

Q112: Wilson Inc wishes to use the revaluation

Q117: What is included in "cash and cash

Q150: Explain why estimates are necessary in accrual

Q156: Which transaction would not be included in