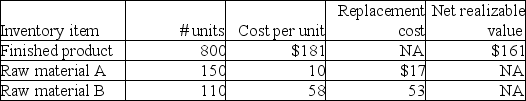

A particular production process requires two types of raw materials to produce the end product.Each unit of finished product requires three units of raw material A and 2 units of raw material B and processing costs of $35.The following provides information on inventories at year-end:

Required:

a.Evaluate these inventories to determine the amount of write-down,if any.

b.Would your answer change if the replacement cost of raw material A were $11 per unit?

Definitions:

Taxable Year

The one-year period that is used for calculating taxes, which can be either a calendar year or a fiscal year.

Property Tax Rate

The percentage of the assessed value of real estate that is payable as tax to the local government.

Mills

In the context of property tax, a mill represents one-tenth of one cent. This unit of currency is often used in tax assessments and signifies the amount of tax payable per dollar of the assessed value of a property.

Gross Income

The total income earned by an individual or a business before any deductions or taxes are taken.

Q24: Which of the following is a difference

Q35: Which statement is correct?<br>A)Private enterprises must follow

Q35: Explain how fixed overhead costs should be

Q44: The following entry was recorded by Hollow

Q78: Which statement is correct?<br>A)The income statement tracks

Q85: The method of depreciation was changed from

Q105: Which statement is not correct about non-strategic

Q108: Which item is an example of a

Q141: Explain how changes in accounting policies,changes in

Q147: Lee Limited began operations on January 1,2016.The