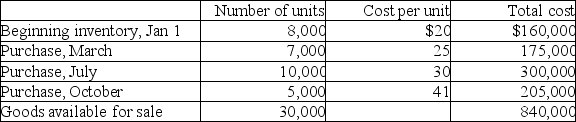

Consider the following inventory information for last year:

The company uses a periodic inventory system.The year-end inventory count indicated 3,700 units in inventory.

Required:

a.Calculate the weighted-average cost per unit for the year.

b.Calculate the ending inventory value and the cost of goods sold for the year.

Definitions:

Double-Declining-Balance Rate

A method of accelerated depreciation where an asset's book value is reduced at double the rate of its straight-line depreciation each year.

Double-Declining-Balance Depreciation

A method of accelerated depreciation that applies twice the normal depreciation rate on the declining balance of an asset.

Straight-Line Depreciation

A technique for spreading the expense of a physical asset evenly across its lifespan.

Depreciation Expense

An accounting method used to allocate the cost of a tangible asset over its useful life.

Q16: Which statement does not describe the "successful

Q20: A company's reported earnings are $1,000 and

Q32: At the end of its first year

Q47: On January 1,2017,a machine was purchased for

Q79: Which statement best explains the gross margin

Q85: Which statement is not correct about the

Q91: Easter Corp.owns a machine that it purchased

Q104: On June 1,Electronics Distribution ships 100 TVs

Q124: Xavier Computer Limited was started in early

Q140: What is the impact of overstating an