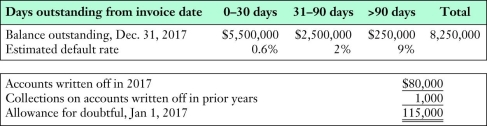

Eastwick Company is preparing its financial statement for the year ended December 31,2017.A summary of Eastwick's accounts receivable sub-ledger shows the following information:

Required:

a.Calculate the amount of bad debts expense required for 2017.

b.Present the journal entry to record bad debts expense for 2017.

c.Present the journal entry that was used to record write-offs for 2017.

d.Independent of the information above,suppose Eastwick factored $1,500,000 of receivables without recourse.In exchange,it received $1,380,000.Present the journal entry to record this transfer of receivables.

e.Independent of part (d),Eastwick instead factored the $1,500,000 of receivables with recourse and received $1,430,000 cash.Both Eastwick and the factor anticipate that 2% of these receivables will prove to be uncollectable,so the factor has held this amount to cover any uncollectable accounts.Should the amount of uncollectable accounts prove to be more or less than 2%,the difference will be paid by/refunded to Eastwick.Present the journal entry to record this transfer of receivables.

Definitions:

Securing Payment

Methods or practices involved in ensuring that payments for goods or services are received in a timely and secure manner, including through contracts, guarantees, or electronic means.

Business-to-Business (B2B)

transactions or relations conducted directly between companies rather than between companies and individual consumers.

E-commerce

The buying and selling of goods and services, or the transmitting of funds or data, over an electronic network, primarily the internet.

Credit Card Transactions

Financial operations where purchases are made or services paid for using a credit card.

Q7: Maybel Company has a March 31,2016 year

Q48: What volume of water would a 52.3-gram

Q51: Amacon Corporation has the following investments at

Q52: If the gross profit percentage used in

Q60: The following entry was recorded by Williams

Q73: Destiny Apartments Inc.(DA Inc. )is building a

Q107: Which of the following is an example

Q113: Marvelos Inc.reported credit sales of $1,000,000,cash sales

Q152: What is the effect of overstating 2018

Q154: Using the data provided below,determine whether the