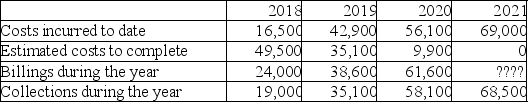

Creation Construction Company (CCC)has contracted to build an office building for Property Corp.The construction started on January 1,2018,and the project was completed on July 1,2021.The contract price was $70 million.Due to uncertainties in the construction process,the two parties to the project agreed to a risk-sharing arrangement whereby Property Corp.covers 50% of all cost overruns in excess of the originally estimated cost of $65 million (e.g. ,if estimated total costs are $69 million,then CCC would receive an additional $2 million for the contract).The following data relate to the construction period.

Required:

Calculate the estimated gross profit (loss)for 2018,2019,2020,and 2021,assuming that the percentage of completion method is used.

Definitions:

Dam

A barrier constructed to hold back water and raise its level, forming a reservoir used to generate electricity or as a water supply.

Fractured Rocks

Rocks that have been broken or cracked due to various geological processes, often creating pathways for fluid movement.

Permeable Rocks

Rocks that allow water to pass through them due to having void spaces or pores.

Geothermal Energy

Energy that can be extracted from Earth’s internal heat.

Q1: Sabrina Inc.reported credit sales of $700,000 and

Q16: How does accounting information help alleviate adverse

Q22: Which statement best describes a private enterprise?<br>A)Any

Q29: What decision would users of financial information

Q31: Explain how a company records revenue and

Q50: Which financial statement element is being described?<br>

Q66: Based on the following information,what amount will

Q131: A particular production process requires two types

Q144: Which statement best depicts the inventory cost

Q147: Lee Limited began operations on January 1,2016.The